Residents and expats in the United Arab Emirates prepare themselves for the expected imposition of 5 percent value-added tax (VAT) in goods and services starting next year.

Water and electricity utilities are in the front row of services that would be subjected to 5% VAT. According to the UAE cabinet, all forms of water and energy utilities like gas and air conditioners are considered supplied goods.

Despite being relieved that rents are spared from VAT, those with vehicles still need to pay for the tax levied on parking charges in their residential buildings.

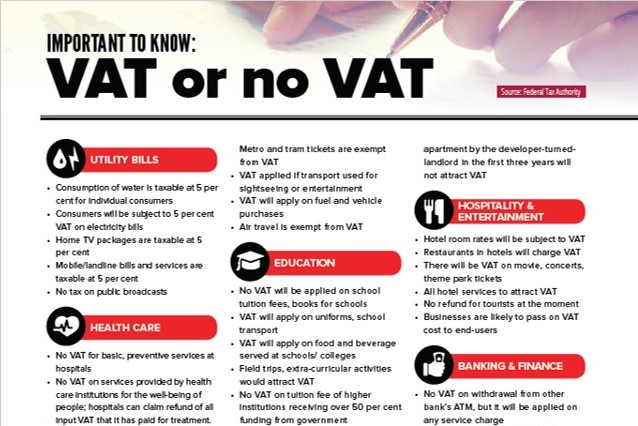

Important to know: VAT or no VAT

Source: Federal Tax Authority

Utility bills

• Consumption of water is taxable at 5 percent for individual consumers

• Consumers will be subject to 5 percent VAT on electricity bills

• Home TV packages are taxable at 5 percent

• Mobile/landline bills and services are taxable at 5 percent

• No tax on public broadcasts

Healthcare

• No VAT for basic, preventive services at hospitals

• No VAT on services provided by healthcare institutions for the well-being of people; hospitals can claim refund of all input VAT that it has paid for treatment. Surgery except cosmetic is zero-rated.

• Hospitals procuring / paying rent for a building will pay VAT

• Products provided by pharmacies certified by Ministry of Health will attract zero percent VAT

Gold jewellery

• No VAT on gold, silver and platinum of 99 percent or more purity

• VAT applied on sale of ornaments

• VAT only on making charge for value addition in the form of new design

• VAT applicable on total amount of jewellery bought

Commuting

• No VAT on buses and taxi fares; Metro and tram tickets are exempt from VAT

• VAT applied if transport used for sightseeing or entertainment

• VAT will apply on fuel and vehicle purchases

• Air travel is exempt from VAT

Education

• No VAT will be applied on school tuition fees, books for schools

• VAT will apply on uniforms, school transport

• VAT will apply on food and beverage served at schools/ colleges

• Field trips, extra-curricular activities would attract VAT

• No VAT on tuition fee of higher institutions receiving over 50 percent funding from government

Retail

• VAT will apply on most of purchase of retail goods

• VAT will be levied on electronics items

• VAT will apply on home appliances

Real estate

• New residential apartment buyers will not pay VAT as first supply within three years from completion

• Buyers of new commercial building/ property will have to pay VAT

• Commercial tenants will have to pay tax; residential tenants will not have to pay VAT on rents

• First lease of residential building/apartment by the developer-turned-landlord in the first three years will not attract VAT

Hospitality & entertainment

• Hotel room rates will be subject to VAT

• Restaurants in hotels will charge VAT

• There will be VAT on movie, concerts, theme park tickets

• All hotel services to attract VAT

• No refund for tourists at the moment

• Businesses are likely to pass on VAT cost to end-users

Banking & finance

• No VAT on withdrawal from other bank’s ATM, but it will be applied on any service charge

• Islamic banks’ products will be treated at par with conventional banks’ products

• Financial services that are conducted without any consideration in the nature of explicit fee, discount, commission and rebate or similar are exempt

• Issue, allotment or transfer of ownership of an equity security or a debt security are exempted

Insurance

• Life insurance has been exempted from VAT

• VAT will apply on auto insurance and applicable on health insurance

• Firms will bear the cost of their employees’ health insurance

• Residents who take health cover on their own will have to pay own VAT