(WAM) – Dubai Statistics Center (DSC) said today that the real gross domestic product at constant prices of the Emirate of Dubai showed a 3.5% decline in the first quarter of 2020. The emirate’s GDP registered a dynamic growth rate of 2.2% in 2019.

The impact of the current worldwide crisis on Dubai in the first quarter of the year was less compared to some of the world’s major economies, DSC noted. The International Monetary Fund (IMF) projects a 4.9% decline in the global economy in 2020, in contrast to a growth of 2.9% in 2019. Advanced and developing economies are expected to decline by 8% and 3% in 2020 respectively while the Middle East and Central Asia are expected to contract by 4.7% in 2020 compared to 1% in 2019.

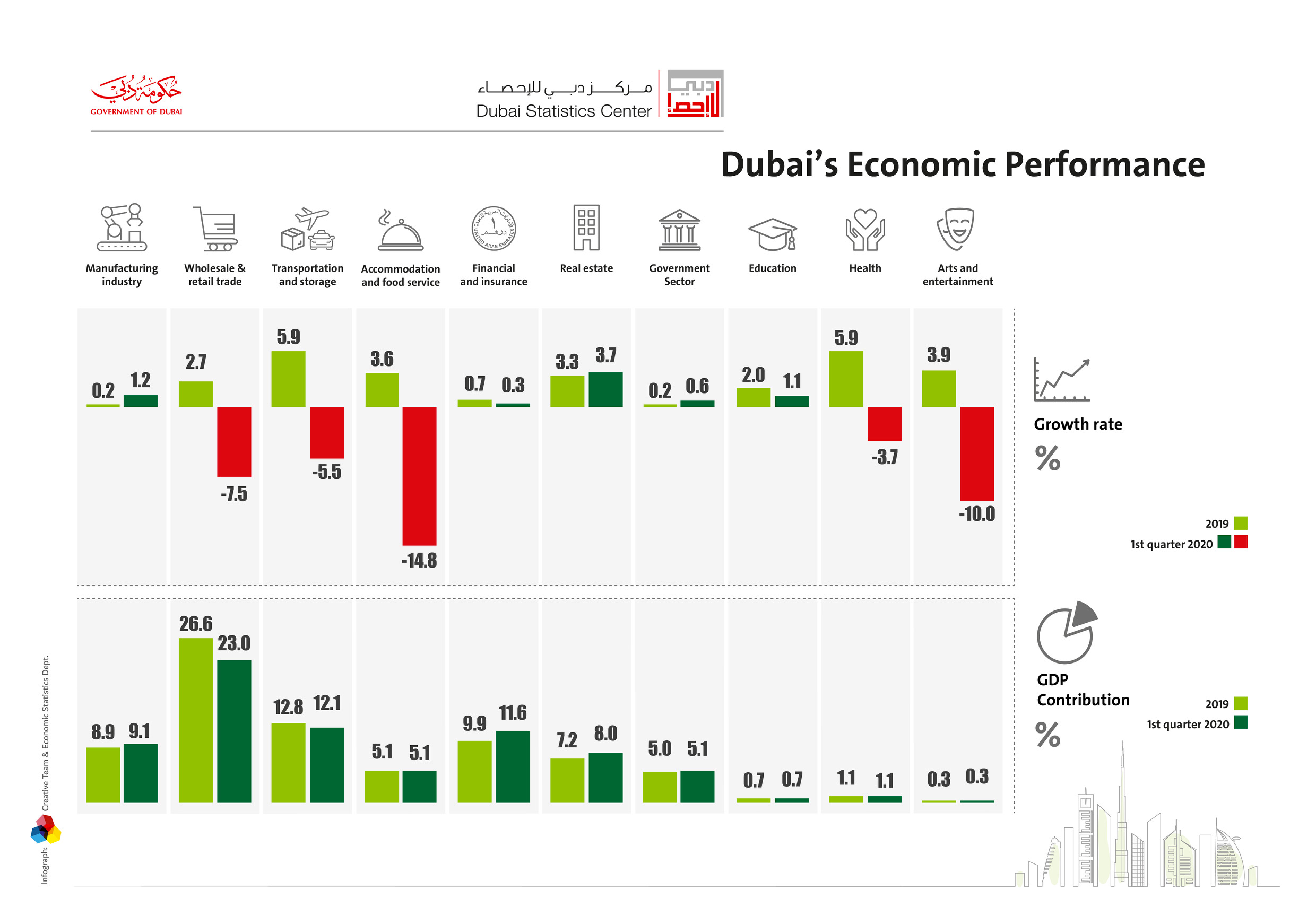

Key sectors of the Dubai economy continued to maintain their dynamism in the first quarter. Real estate, finance, manufacturing and the government sector retained their growth momentum in Q1 2020.

Arif Al Muhairi, Executive Director of DSC, stated, “Dubai’s economy witnessed healthy levels of growth in 2019. It was expected that in the first quarter of 2020, the economy will experience a decline due to the global impact of the COVID 19 pandemic.”

“The worldwide restrictions on movement for individuals through air, sea, and land entry points, as well as the unprecedented intensification of precautionary measures, which limited the flow of freight across borders, had significant repercussions on international trade and the global economy.

RELATED STORY: Abu Dhabi to reopen gyms, fitness centers

“Being a central player in international trade and a vital global passenger transit hub, Dubai’s economy was affected by these exceptional circumstances,” he added.

However, thanks to the advanced infrastructure and capabilities of Dubai’s economy and the flexibility of its strategic decision-making system, it has successfully managed the global crisis and reduced its impact when contrasted with other economies, he said.

Adaptability to global circumstances Given the larger global economic reality in 2019 and the first quarter of 2020, Dubai has shown continued dynamism and resilience and proven that it can adapt to unforeseen challenges.

In 2019, Dubai’s GDP reached AED407.42 billion, a rise of 2.2% from 2018.

“Dubai’s competitive markets and its efficient economy stimulated demand. This boosted the productivity of its various economic sectors and advanced overall growth in 2019,” said Al Muhairi.

The dynamic growth in economic activities in 2019 reflects the flexibility of the economy and the leadership’s ability to formulate sound policies to stimulate economic progress in Dubai, despite the global economic environment.

Al Muhairi said that trade, transport and storage activities contracted in Q1 2020 compared to Q1 2019. Though trading activity declined by 7.5% in the first quarter of the year, it retained its status as the largest contributor to the emirate’s economy, accounting for 23% of total GDP. Transport and storage activities declined by 5.5% but remained one of the highest contributors to Dubai’s economy accounting for 12.1%, placing it just behind the trading sector. While the sector benefited from the significant decline in operating costs, such as aviation fuel cost, the decline was not enough to make up for the dip in revenues.

The Executive Director of DSC considered the decline a natural result of the current global economic environment, given that the transport and storage sectors play a crucial role in supporting other economic sectors and directly support regional and international trade and the travel sector. He noted that strong policy measures enabled Dubai to minimise the negative impact of the crisis on these two strategic sectors.

READ ON: UAE announces gradual reopening of mosques, places of worship

Al Muhairi revealed that Dubai’s 2019 GDP growth was driven by the performance of trading activity, which achieved a growth of 2.7% in 2019. Trade contributed 26.6% of Dubai’s total GDP and 32% of total economic growth in 2019.

“The strategic and historical importance of trade in Dubai’s economy, the continuous focus it receives, and the supportive policies and services that enhance its performance enable trade to account for the largest share of the emirate’s economy,” Al Muhairi said.

In 2019, transport and storage activity ranked second in terms of its contribution to the economy. The sector registered a growth of 5.9% and contributed approximately 12.8% of Dubai’s GDP and nearly 33% of total growth achieved in 2019.

“Transport, shipping, warehousing, and other support services are indispensable and fundamental in facilitating the movement of trade between the world and the region via Dubai. The emirate’s exceptional infrastructure enables Dubai to play a vital role as the main gateway for the flow of goods between the region and the world.”

The accommodation and food services sector (hotels and restaurants) was among the other major set of economic activities affected by the COVID-19 pandemic in the first quarter of this year, declining by 14.8% from the same period in 2019. The sector contributed 5.1% to the overall economy of the emirate. The decline was expected given the movement restrictions in place during the height of the lockdown as well as the prohibition of foreign and domestic tourism and the temporary closure of hospitality establishments. In countries across the world, this sector has suffered a steep decline.

As for 2019, the accommodation and food services sector’s performance was in marked contrast to Q1 2020. The sector achieved a growth of 3.6% in 2019, accounting for 5.1% of Dubai’s overall economy. Its contribution to economic growth increased by 8.2% in 2019 from the year before. Through events, promotions, and festivals, visitors to Dubai spent longer periods in the emirate. A deeper look at activity in the sector showed that arts, entertainment, and recreation activities grew by 3.9% in 2019. This demonstrates the interdependence between Dubai’s various economic activities and the cross-sector impact of promotional strategies.

Unlike other sectors, real estate activity registered a growth of 3.7% in Q1 2020 compared to Q1 2019, contributing 8% to the overall economy and pushing it higher by 0.27 percentage points. These figures show how sustained dynamism in the real estate sector has helped to mitigate the impact of the global crisis on Dubai’s economy.

2019 figures show that the real estate sector achieved a growth of 3.3%, accounting for 7.2% of Dubai’s real GDP or a value added of AED29.4 billion compared to AED28.5 billion in 2018. This represented a 10.7% contribution to Dubai’s overall economic growth.

Al Muhairi stressed that Dubai provides excellent world-class infrastructure and logistics services and an attractive legislative and administrative system for real estate investment. The performance of the sector is measured through rental transactions, the margins achieved in sales and purchases and the commissions recorded through real estate brokerage.

Dubai’s health sector declined by 3.7% in Q1 2020 due to the need to allocate the majority of health resources to combating the COVID-19 pandemic, whereas the education sector recorded a growth of 1.1% during the same period as a result of the continuation of the educational process through online learning.

The productive sectors (agriculture, mining, manufacturing, construction, and electricity) grew at a modest rate of 0.34% in 2019. Together, their growth accounted for 3.1% of total growth. In Q1 2020, these activities witnessed a slight decline of 0.5% but contributed 20.9% to Dubai’s overall economy. The modest dip can be attributed to the fact that they are classified as vital sectors and the impact of preventive measures on them was minimal. These vital sectors remained active during the lockdown since they played critical roles in securing the needs of the society and supporting precautionary measures and business continuity plans of vital facilities.

The finance and insurance sector recorded a positive trend registering a slight growth of 0.3%, despite the challenging global economic conditions. The growth can be attributed to the fact that it is a vital sector whose technical capabilities contributed to reducing the impact of the COVID-19 pandemic, and the fact that it managed to provide services remotely without direct communication between customers and service providers during the period of movement restrictions. The sector contributed 11.6% to Dubai’s overall economy in Q1 2020. In 2019, financial and insurance activities achieved a growth of 0.7%, accounting for 9.9% of Dubai’s real GDP in 2019.

The UAE Central Bank’s data indicated that the credit balance of all UAE banks witnessed a growth of 5.6% in 2019 to reach approximately AED1.6 trillion. An analysis of credit data shows that 21% of the credit volume was for personal and consumption purposes, which contributed to boosting the purchasing power and demand for goods and services. Meanwhile, 19.5% of this credit balance was devoted to the construction and real estate sector compared to 9.6% dedicated to trading activity.

According to data revealed by the UAE Central Bank, total internal deposits of all UAE banks increased by 6.9% in Q1 2020. Non-resident deposits rose by 3.7%. Corporate deposits accounted for 37% of total deposits, while individual deposits accounted for 26%. These deposits show that UAE banks are capable of responding to credit demand and promoting economic development by providing financing.

The UAE Central Bank’s quarterly review shows that the volume of banking sector credit extended to residents grew by 4% in Q1 2020 compared to Q1 2019. This distribution of credit among economic activities is similar to that of 2019. Relief measures rolled out by banks for individuals and companies in line with government directives contributed to easing the financial impact of the global COVID-19 crisis on families and organisations.

Al Muhairi also revealed that the public sector registered a growth of 0.6% in Q1 2020 compared to Q1 2019. The sector accounted for 5.1% of Dubai’s real GDP. The role played by the public sector was significant in mitigating the impact of the global economic crisis experienced in Q1 2020. In 2019, the public sector grew 0.2% and contributed 5% to Dubai’s real GDP.