For the first time in Philippine history, the local currency trades for P58 pesos against the US dollar on Wednesday, September 21. This exceeds P57.5 highest intraday rate on Tuesday.

The exchange rate opened at a new all-time low P57.7 and closed at P58 according to the Bankers Association of the Philippines. This is a new all-time low in the Philippine currency history.

Read: Philippine peso trades for P57.5 intraday on Tuesday

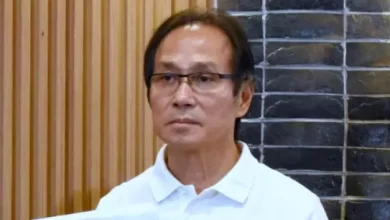

Mr. Rainier Ric dela Cruz, a Former Economist of the Philippine Competition Commission and a current PhD Econ student of the University of Ottawa explained why the peso has weakened against the US dollar in recent months.

“The major reason is because of inflation and the response of the US Federal Reserve (the equivalent of our Central Bank) to counteract it. In order to combat inflation, the Fed has raised major interest rates, which in turn, has made the US more attractive to investors,” said dela Cruz.

This means that there is greater demand for the US dollar compared to other currencies, including the Philippine peso.

“High demand for USD means a higher price for the dollar, which is reflected in the exchange rate. Dahil diyan, mas maraming piso ang kailangan mong gamitin para makabili ng isang dolyar ngayon,” said dela Cruz.

Dela Cruz further explained that the reflection of the high exchange rates cannot directly reflect the Philippine economy.

“We cannot immediately say whether a high exchange rate is good or bad for the economy because this will depend on a lot of factors, including whether a country is export-driven or relies more on imports, and other things.

Who loses?

According to dela Cruz, to analyze the impact of this peso depreciation on the Philippine economy, it is important for everyone to first understand who benefits and who loses from a low exchange rate.

He listed down a set of advantages and disadvantages of the current high exchange rates.

Advantages:

- OFWs and their relatives are said to benefit because remittances in USD are now higher. However, the positive effect on these remittances is likely to be negated because of higher prices, since imported goods are now more expensive.

- Exporters also benefit from a weaker peso because the goods that we export are now relatively cheaper (i.e. foreigners using USD can now buy more since the dollar is worth more). This is good for Philippine businesses which export to other countries. For example, think of Japan or South Korea which has benefitted from a low yen or a low won for decades, allowing them to export their electronic products to other countries.

“It is important to note, however, that the Philippines, is a net importer, that is, we import more than we export, and this is still true based on recent data,” said dela Cruz.

Disadvantages:

- Debt servicing – since the Philippine government has a lot of foreign debt in USD, a higher exchange rate means that we have to pay more compared to before

- Importers – A higher exchange rate is bad for importers, because we now have to pay more for the same amount of goods. And the Philippines imports a lot of products from other countries, including petroleum and other inputs. When inputs are more expensive because of a higher exchange rate, other sectors are also affected. Higher petroleum prices = higher fares in jeepneys, buses, taxis, etc. We are also seeing higher prices of other commodities, including basic goods like rice, and salt, a lot of which we still import.

- Travelers – Filipinos who travel to the US and other countries which accept USD also need to pay more to exchange our local currency

Predominantly, dela Cruz pointed out that the high exchange rates does not signify an improved or strong economy.

“Hindi ibig sabihin na dahil mataas ang exchange rate ay lumalakas ang ekonomiya ng Pilipinas o nakikinabang ang mga Filipino. Sa katunayan nga, hindi naman domestic kundi mas international ang sanhi ng pagbaba ng piso kontra dolyar ngayon, gaya ng sinabi ko sa unang bahagi. At hindi rin ibig sabihin kaagad na nakabubuti ito sa mga Filipino, dahil nga marami ang maapektuhang sektor. Importanteng isipin ang mga positibo at negatibong epekto, at kung ano ang mas nangingibabaw,” said dela Cruz.