For Filipinos abroad, sending money home is a way of bridging the distance, ensuring loved ones have what they need while staying part of everyday life. Every transfer is a quiet act of care, a gesture that supports dreams, handles responsibilities, and keeps family bonds strong across miles.

With its new campaign, botim highlights how money can carry emotion, connecting 8.5 million users in the UAE and 157 million globally through meaningful financial moments. Its new TVC, part of the “let your money say botimmmm” campaign, blends humor, heart, and cultural familiarity to show that sending money is more than a transaction — it’s a way to support, celebrate, and be present for others.

Today, botim money is much more than the app OFWs once knew for calling home. It has evolved into a comprehensive, all-in-one fintech platform designed to simplify everyday money matters, built with the real needs of OFWs in mind.

Here’s how it’s helping Filipinos in the UAE manage money smarter, faster, and more securely.

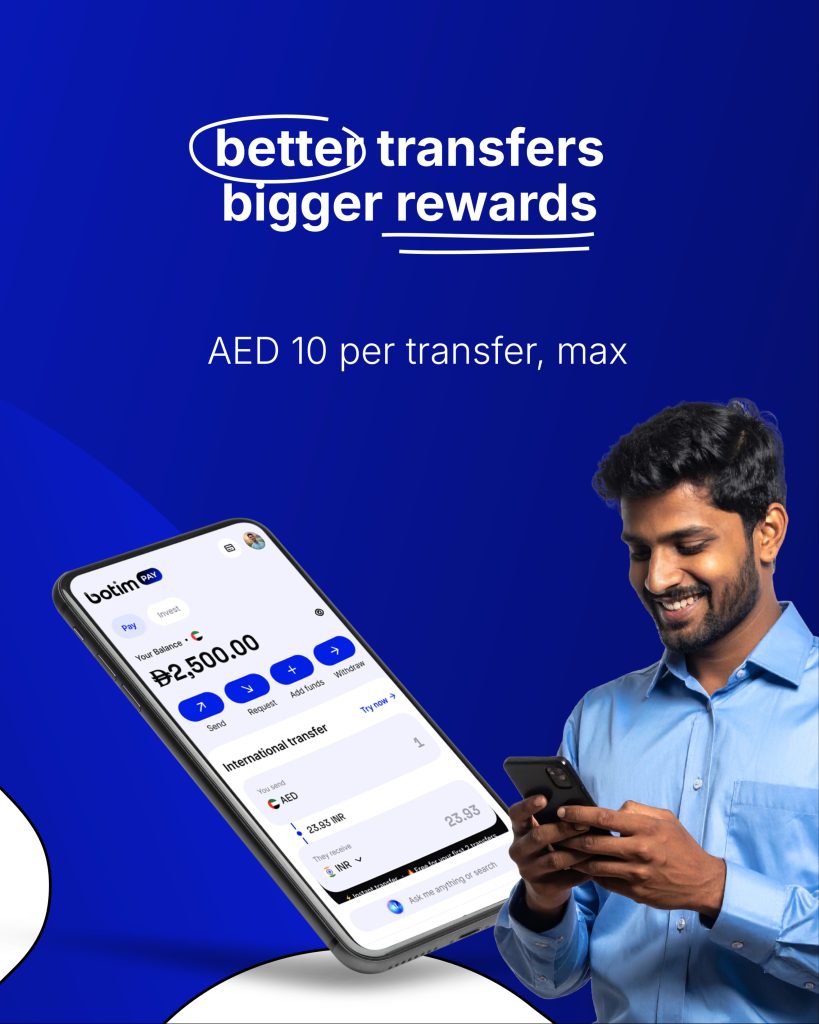

Fast, affordable, and reliable

Sending money home doesn’t have to be stressful or expensive. With botim money, remittances to over 150 countries are up to 30% cheaper than traditional services — fast, secure, and reliable (T&C’s apply). Every transaction, whether it’s tuition fees, household expenses, or a surprise gift, carries meaning, giving peace of mind that support reaches loved ones instantly.

Your finances in one place

Managing multiple financial responsibilities becomes effortless with the botim Wallet. Users can send or request money, withdraw to their bank account, or transfer wallet-to-wallet — all digital and instant. Activation is straightforward, with no paperwork or salary requirement, putting full control of finances right at your fingertips.

Local transfers for everyday use

Whether you’re out grocery shopping, grabbing a coffee, or covering small daily expenses, botim money allows you to send dirhams instantly to wallets or bank accounts — real-time, free, and hassle-free. Everyday transactions, from splitting bills to sending emergency support, become simple, seamless, and stress-free.

Invest for the future

Investing in gold has never been easier. With as low as AED 40, users can start growing their wealth, earning ~3% p.a. guaranteed, credited monthly. As gold increases in value, potential returns can reach up to 16% p.a., and funds can be sold anytime. This transforms everyday savings into a smart, flexible investment that supports both immediate needs and long-term goals.

Bills & recharge

Paying bills and topping up services is fast and convenient with botim money. From postpaid plans to road tolls, payments can be completed in seconds, removing queues and delays. Managing routine obligations has never been this straightforward, leaving more time for family, work, or personal life.

Send Now, Pay Later

For urgent support or unexpected needs, the Send Now, Pay Later (SNPL) feature allows transfers of up to AED 5,000 with flexible repayment plans of up to six months and no hidden fees. For OFWs, this means they can respond to urgent needs without financial strain, keeping family-first priorities intact while managing their own budgets responsibly.

Why OFWs are choosing botim

From international transfers and local payments to investments, credit, and prepaid cards, botim money keeps finances simple, intuitive, and human-focused. It’s designed around the way people live, work, and care for family — making money feel less like a task and more like a meaningful connection.