The state-run Home Development Mutual Fund (Pag-IBIG) announced a series of member-focused initiatives aimed at boosting savings returns, easing housing loan costs and expanding access to affordable properties during the “Gawad Pag-IBIG para sa Media” event held Tuesday at the Manila Hotel.

Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta said the agency expects to sustain strong performance this year. As of January to November 2025, Pag-IBIG reported total assets of ₱1.22 trillion, with 17.03 million active members, ₱88.33 billion in short-term loan releases, and financial assistance extended to more than 3.5 million members.

Acosta also said members may see higher dividend rates, building on 2024’s payouts of 6.60% for regular savings and 7.10% for the MP2 voluntary savings program, among the highest in recent years.

Online bidding, lower interest

Acosta also highlighted lower interest rates under the Expanded Pambansang Pabahay para sa Pilipino (4PH) Program, particularly for socialized housing loans. Under the program, borrowers may avail of a subsidized interest rate of 3% for the first five years of their housing loan, a move aimed at making homeownership more accessible to low-income families.

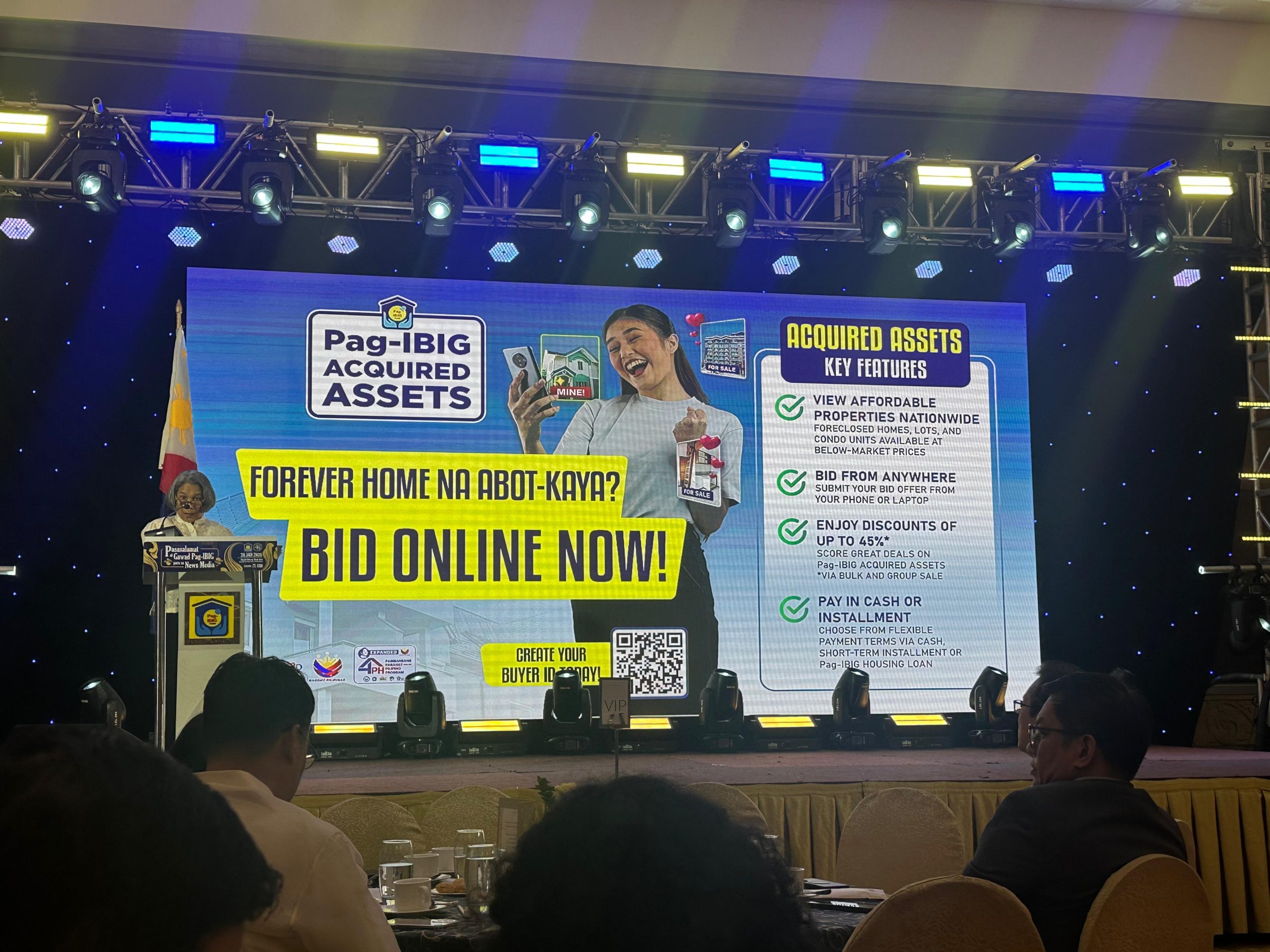

Another major announcement was the rollout of Pag-IBIG Fund’s online property bidding platform, which allows members, including overseas Filipino workers, to bid remotely on acquired assets nationwide.

The platform features foreclosed homes, residential lots and condominium units offered at below-market prices, with discounts of up to 45%. Members can submit bids online using their mobile phones or laptops and choose from flexible payment options, including cash, short-term installment plans, or housing loans through Pag-IBIG.

Pag-IBIG Vice President Jack Jacinto delivered the welcome remarks at the event, which recognized members of the media for their role in promoting public awareness of Pag-IBIG Fund programs and services.