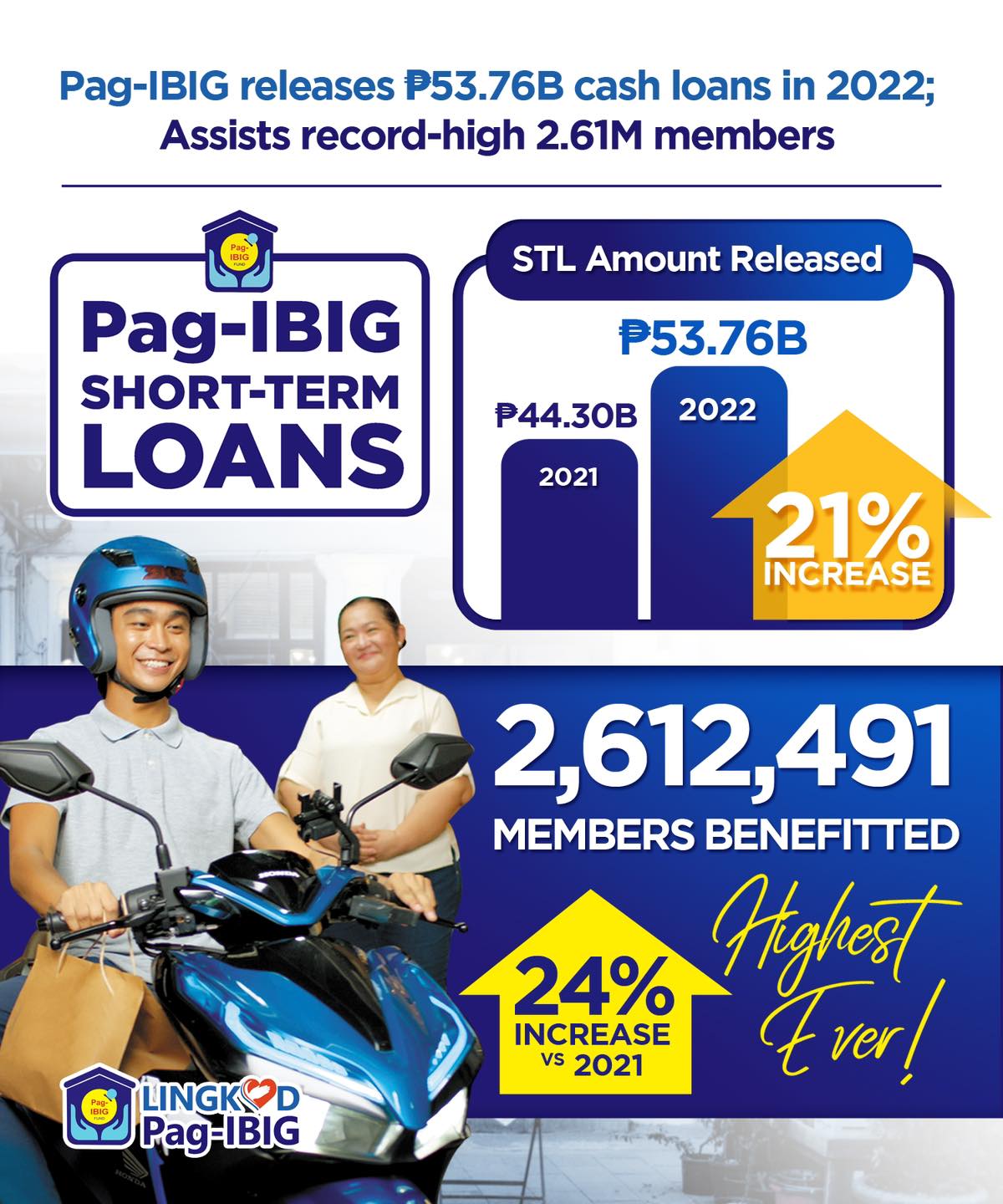

Pag-IBIG, one of the largest sources of home financing of Filipinos, has disbursed P53.76 billion in cash loans, also known as short-term loans, assisting a record-high 2,612,491 members in 2022, according to the agency on Tuesday.

In a recent statement, Pag-IBIG announced that the amount of short-term loans released by the agency in 2022 grew by 21 percent or P9.46 billion compared to the P44.30 billion released in 2021.

Given these figures, the number of members who benefitted through the program rose by 24 percent or over half a million more than the 2,090,851 members in 2021.

According to Human Settlements and Urban Development Secretary Jose Acuzar, who also heads the 11-member Pag-IBIG Fund Board of Trustees, all their “efforts are in line with the call of President Ferdinand Marcos, Jr. to provide the best service to the Filipino people.”

“We at Pag-IBIG Fund exert all efforts in providing our members with assistance on their financial needs. We are happy to note that through our Short-Term Loan Program, we were able to aid more than 2.6 million Filipino workers gain added funds to tend to their needs last year,” Acuzar said in a recent release.

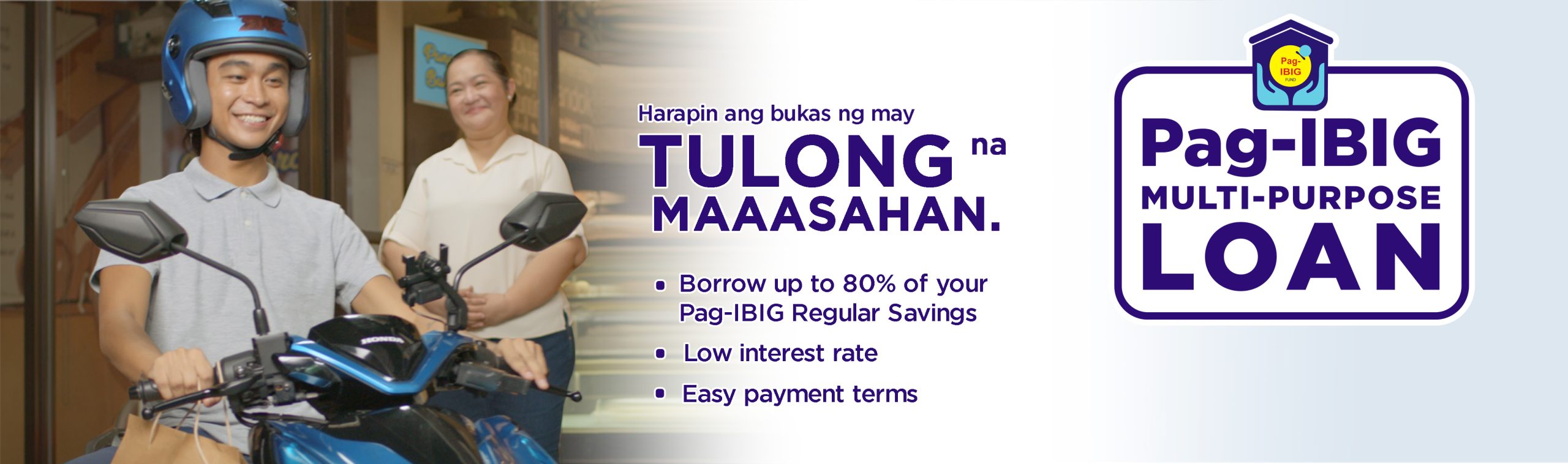

Pag-IBIG Fund’s Short-Term Loan Program includes the agency’s Multi-Purpose Loan (MPL) and Calamity Loan.

Under the Pag-IBIG MPL, qualified members can borrow up to 80 percent of their total Pag-IBIG Regular Savings and can be processed in as fast as two days. Borrowers may choose between a 24 or 36-month payment term and are provided a two-month grace period prior to their first payment. It comes at an interest rate of 10.5 percent per year.

On the other hand, the Pag-IBIG Calamity Loan, is made to assist members residing or working in areas declared under a state of calamity.

As members, overseas Filipino workers can also apply for short-term cash loans while working abroad through its online service facility.

Meanwhile, Pag-IBIG Fund Chief Executive Officer Marilene Acosta noted that the reliability and ease of access in availing the cash loans are the main drivers for its strong growth.

Acosta highlighted that more channels are now available for members to “easily and conveniently” apply for these loans.

“Today, our members can easily and conveniently apply for these loans through many channels, which include their employers, our more than 200 branches and services offices nationwide, or online via the Virtual Pag-IBIG or the Virtual Pag-IBIG Mobile App. What’s more, we also have our Lingkod Pag-IBIG On Wheels which are currently going around the country, ready to receive loan applications from members particularly those from underserved and calamity-stricken areas,” Acosta added.