The UAE has made it mandatory for private sector employees, including both Emirati and expat workers, to register for a new insurance scheme known as the Involuntary Loss of Employment (ILOE) insurance. This policy, which went into effect on January 1, aims to provide financial protection to workers who find themselves unexpectedly out of a job. Those who do not register for the ILOE insurance by the June 30 deadline will be subject to a fine of AED400.

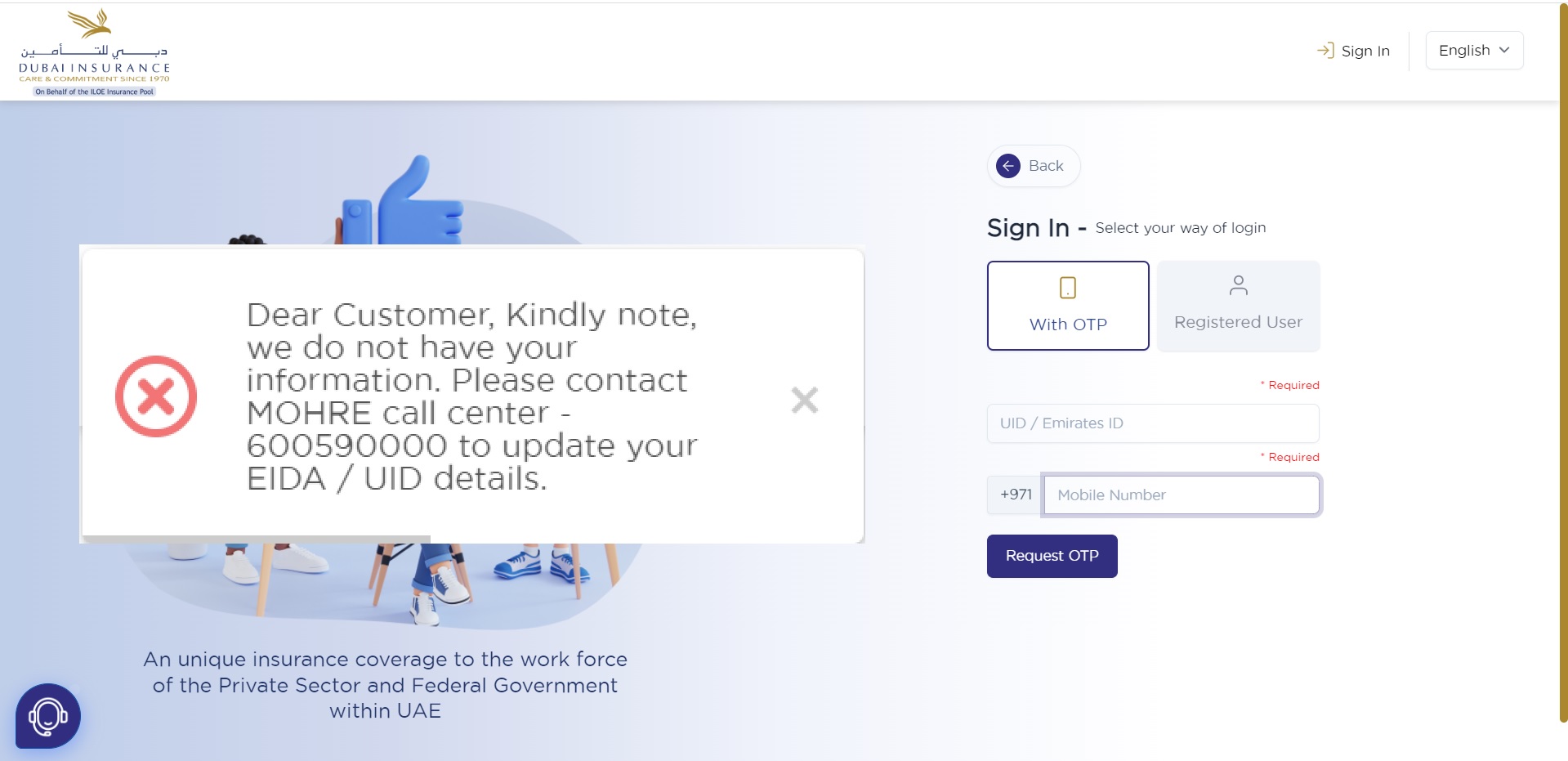

During the registration process, some employees have reported receiving a message stating that their information is not available. Here’s what you can do.

- Contact the Ministry of Human Resources and Emiratisation (MoHRE) call center: 600590000

- Employees in the private sector should submit a technical support ticket through the MoHRE website or mobile app, or contact the MoHRE call center to update their EIDA/UID details.

- Federal government employees who encounter this issue should contact their human resources department.

Under the terms of the ILOE insurance scheme, employees with a basic salary below Dh16,000 are required to pay a monthly premium of Dh5 or an annual premium of Dh60 plus VAT. These employees will be compensated with 60% of their average basic salary for three consecutive months in the event of job loss. Employees with a basic salary of Dh16,000 or above must pay a monthly premium of Dh10 or an annual premium of Dh120. The policy period is available for one or two years, and subscriptions can be made through Dubai Insurance, the ILOE website, Al Ansari Exchange, or ATMs.

It’s important to note that employees working in the UAE’s free zones are exempt from registering for the ILOE insurance scheme. In addition, the insurance program does not provide coverage to investors, domestic helpers, part-time employees under the age of 18, retirees receiving a pension and starting a new job, or owners of the establishments in which they work.

The implementation of the ILOE insurance policy is just one of the measures that the UAE government has taken in recent years to improve job security and financial stability for its citizens and expat workers. With the COVID-19 pandemic causing widespread economic disruption, the availability of this insurance provides a much-needed safety net for those who may find themselves out of work.

By requiring private sector employees to register for the ILOE insurance, the UAE government is taking a proactive approach to protecting its workforce. While the AED400 fine for non-compliance may be viewed as a deterrent, the real value of the ILOE insurance lies in the financial support it offers to those who lose their jobs. With the policy covering both Emirati and expat workers, it represents a fair and inclusive approach to addressing the challenges posed by job loss.