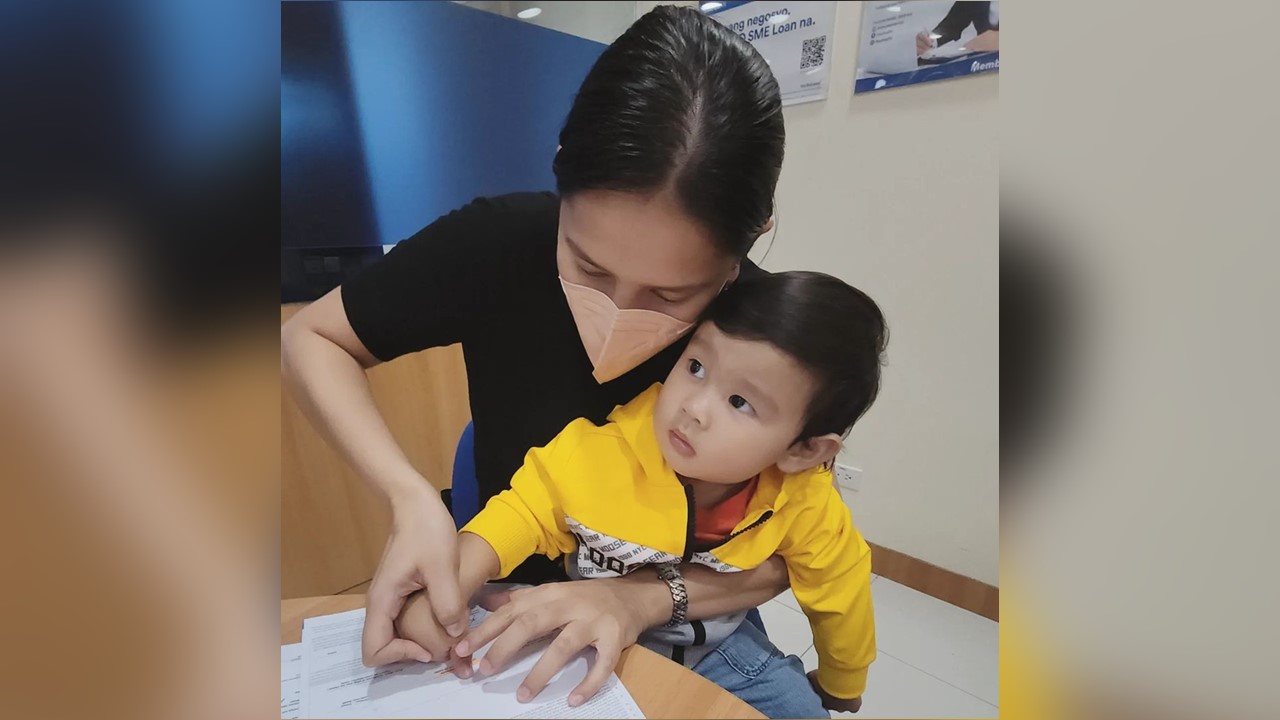

Neri Naig and Chito Miranda’s son, Cash, is poised for financial stability at the age of one after his mom opened up two insurance accounts: one for stocks and the other for life insurance.

“At nakakuha na rin ako ng 2 insurance si Cash. Isa pang stocks at isa life insurance. Para kapag seniors na sila, di sila maghihintay ng ibibigay ng mga magiging anak nila.. kukunin na lang nila sa insurance nila. O di ba? Sobrang advance ako mag isip?,” said Naig.

“Hanggang sa pagiging senior nila, gusto ko naka ayos na 😅 WAIS eh! 🤣 at ituturo ko rin sa mga anak namin na ganun din ang gagawin para sa mga anak nila para mas panatag sila na magiging ok ang kinabukasan ng mga bata,” she added.

Months earlier, Neri also invested in a property for her one-year-old son.

Because she freely shares her advice on being ‘wais’ (wise), from managing a home to starting a business, Neri has been receiving raves and praises from Filipinos around the world. She revealed that the cash she used for Baby Cash’s insurance was paid for by his endorsement fee, talent fee, and financial gifts from his ninongs and ninangs.

“Inaayos ko na talaga yung future ng mga bata. Ayun ang trabaho nating mga magulang, ang siguraduhin magiging maayos sila hanggang sa pagtanda. Wag na wag natin isipin na keyso pinag-aral natin sila ay sila na ang bahala sa atin sa pagtanda. Hayaan natin silang mag grow at mahanap nila yung buhay na gusto nila,” said Neri.

She divides Cash’s funds into three categories: savings, insurance, and real estate or business investments – meaning that the one-year-old already has a financial portfolio at such a young age.