The Philippine economic officials have taken center stage at the 2023 Philippine Economic Briefing in Dubai, an event designed to explore investment opportunities and the business potential of the Philippines. The gathering has fostered crucial discussions with influential business leaders and investors from across the region.

The distinguished Philippine delegation includes Secretary Benjamin E. Diokno of the Department of Finance, Secretary Amenah F. Pangandaman of the Department of Budget and Management, Secretary Arsenio M. Balisacan of the National Economic and Development Authority (NEDA), Deputy Governor Francisco G. Dakila, Jr. of the Bangko Sentral ng Pilipinas, H.E. Alfonso Ferdinand A. Ver, Ambassador of the Republic of the Philippines to the United Arab Emirates, and Assistant Governor Arifa A. Ala of the Bangko Sentral ng Pilipinas.

Secretary Diokno, addressing the audience at the briefing, introduced the groundbreaking Maharlika Investment Fund, emphasizing its versatility with the statement, “The Maharlika Investment Fund can also be used for green and blue projects, countryside development, and emerging mega-trends such as ESG and cutting-edge technologies. We look forward to operationalizing the fund before the end of the year.”

Answering a question from The Filipino Times, Sec. Diokno emphasized the government’s need to prioritize both physical and digital connectivity.

“[There are] two areas where we need foreign investors, specifically, the Philippines being an archipelagic country, we need connectivity, right? Not only physical connectivity, but also digital connectivity,” said Secretary Diokno.

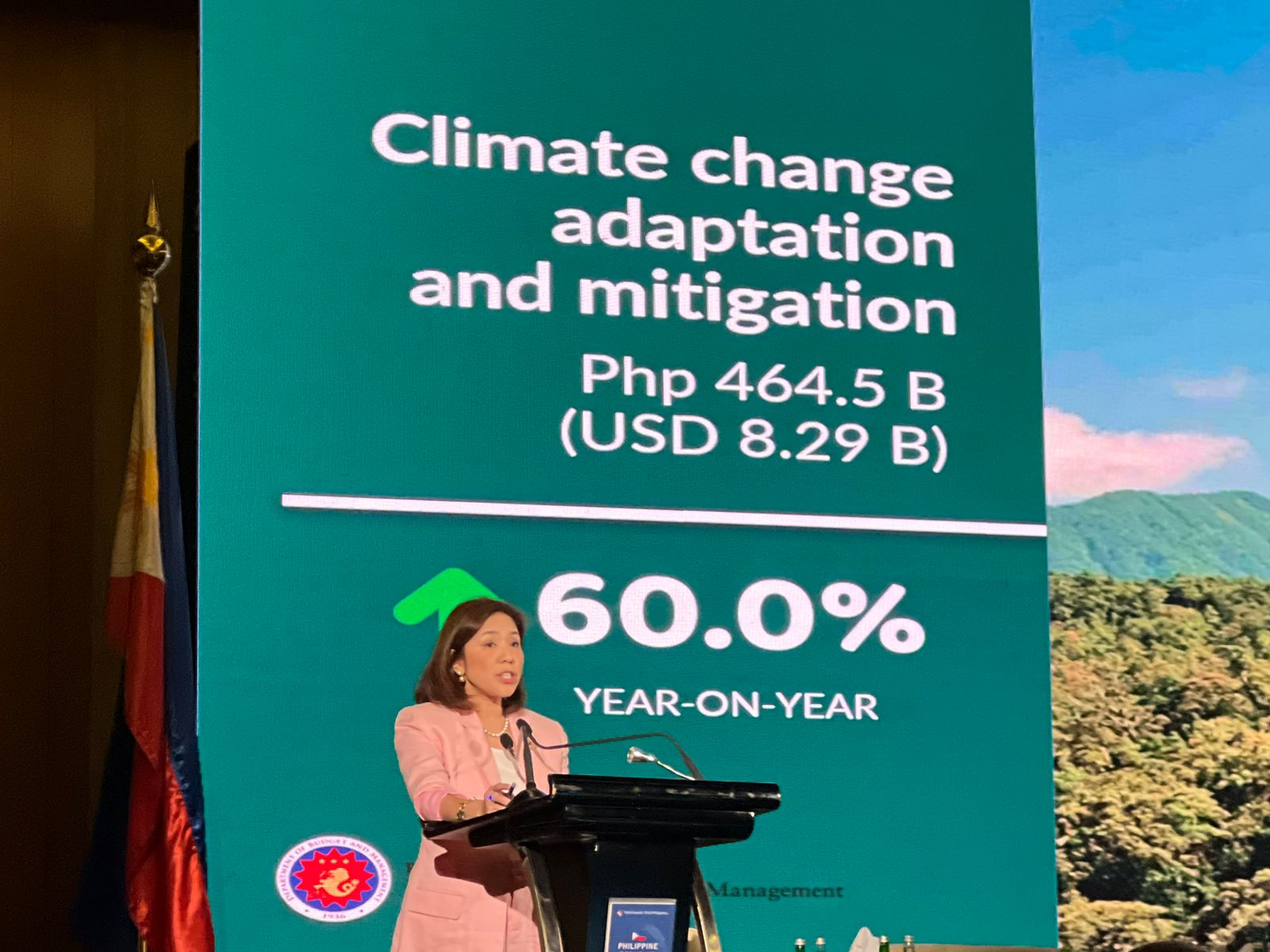

Supporting this statement, Secretary Amenah Pangandaman of the Department of Budget and Management added: “On the digital transformation, all national government agencies have increased the budget of agencies on ICD for next year, it increased to up to 60%.”

Investing on energy

They also presented the energy sector as another promising opportunity for the attending entrepreneurs and businessmen during the event.

“The second area I think is energy, but clean energy because we want to transition from a dirty source of energy to cleaner energy and again, we need a lot of investment there and as I mentioned earlier, we have opened up that area, so you can invest in solar, wind, tidal, whatever. So those are critical,” said Sec. Diokno.

National budget allocation

In a presentation on the priority expenditures supporting the Philippine Development Plan, Sec. Pangandaman highlighted the robust economic performance of the Philippines and its attractive investment opportunities.

She specifically addressed the national budget, stating, “We have allocated a significant portion of our budget to the social services sector, with 17% dedicated to education, a 16% increase in health funding, and a substantial 11.7% allocation for social protection, which is 9% higher than in 2022.”

In an exclusive interview with TFT, Sec. Pangandaman thanked the OFWs for keeping the economy afloat, especially during the pandemic.

“Unang-una, nagpapasalamat po kami, ang entire administration ng pangulo at ang economic team for helping our economy afloat during the pandemic. Natulungan niyo po ng malaki ang ating bansa nung nagkaroon po tayo ng pandemic, habang nakasarado po ang ating ekonomiya. Ngayon po na nagbubukas na ang ating ekonomiya, kami po ay nandito para mangalap ng mga investment opportunities para magkaroon tayo ng marmaing trabaho at hopefully po makauwi kayo sa atin at mabigyan kayo ng magandag buhay,” said Sec. Pangandaman to TFT.

Ease of doing business

Secretary Arsenio Balisacan, representing the National Economic and Development Authority (NEDA), emphasized the Philippines’ commitment to policies that support foreign investments. He stated, “The country is opening up its economy. Secretary Diokno mentioned some of these reforms, which allow 100% foreign equity in many areas of the economy, including infrastructure such as tollways and railways. Simultaneously, we have been addressing the ease of doing business and anti-red tape to make investing in the Philippines more attractive.”

Addressing inflation

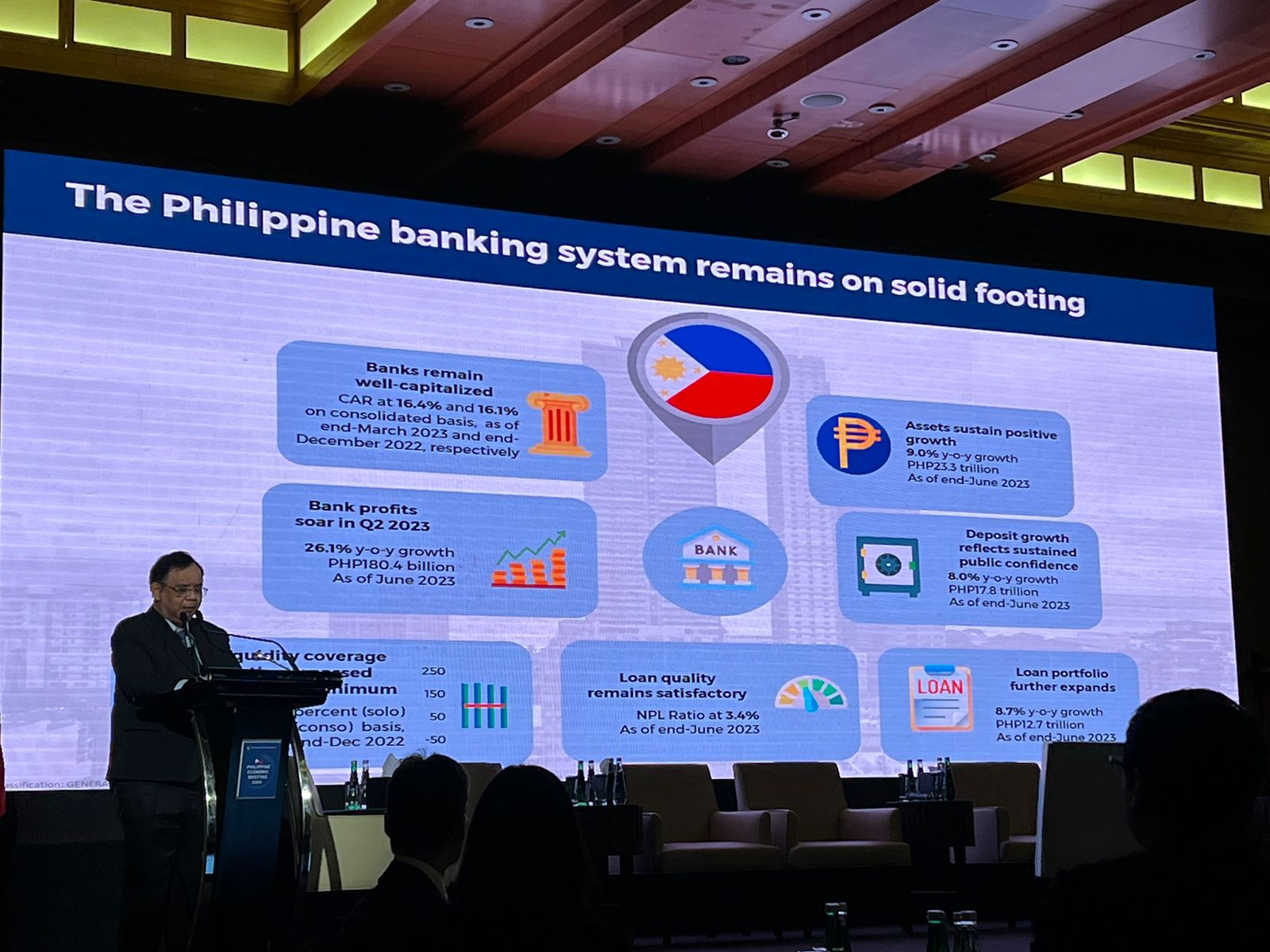

Deputy Governor Francisco Dakila of the Bangko Sentral ng Pilipinas shed light on the nation’s strategy for tackling inflation and ensuring economic stability. He stated, “We have implemented strategies aimed at bolstering farm productivity. President Marcos recently established an inter-agency committee focused on addressing inflation and monitoring market dynamics. This advisory body assists the President in devising measures to mitigate factors that impact food prices and overall economic stability.”

Furthermore, Dakila emphasized the importance of non-monetary measures in the fight against inflation. He highlighted key initiatives such as strengthening the Kadiwa program to facilitate direct connections between consumers and producers, ensuring timely and sufficient imports of essential commodities, and providing targeted cash transfers and subsidies to support vulnerable stakeholders.

Deputy Governor Dakila also underscored the ongoing need for a cautious approach to monetary policy, stating, “Given that inflation risks still lean towards the upside, it remains prudent to maintain a stable monetary policy stance. This approach aims to secure price stability, fostering an environment conducive to sustainable economic growth without inflationary pressures.”

In a separate press briefing, the Philippine economic team also revealed that Overseas Filipino workers (OFWs) will soon gain access to their government’s retail dollar bonds as part of a strategy to raise $2 billion through this initiative, extending the opportunity to UAE-based OFWs by the end of the month.

National Treasurer Rosalia de Leon explained that these bonds, designed to appeal to overseas Filipinos, will be accessible via e-wallets. Finance Secretary Benjamin Diokno highlighted their potential benefits, emphasizing their use in financing infrastructure projects.

Responding to a question from TFT, de Leon emphasized that the initiative will exempt OFWs from up to 20% in taxes that a regular investor would typically bear.

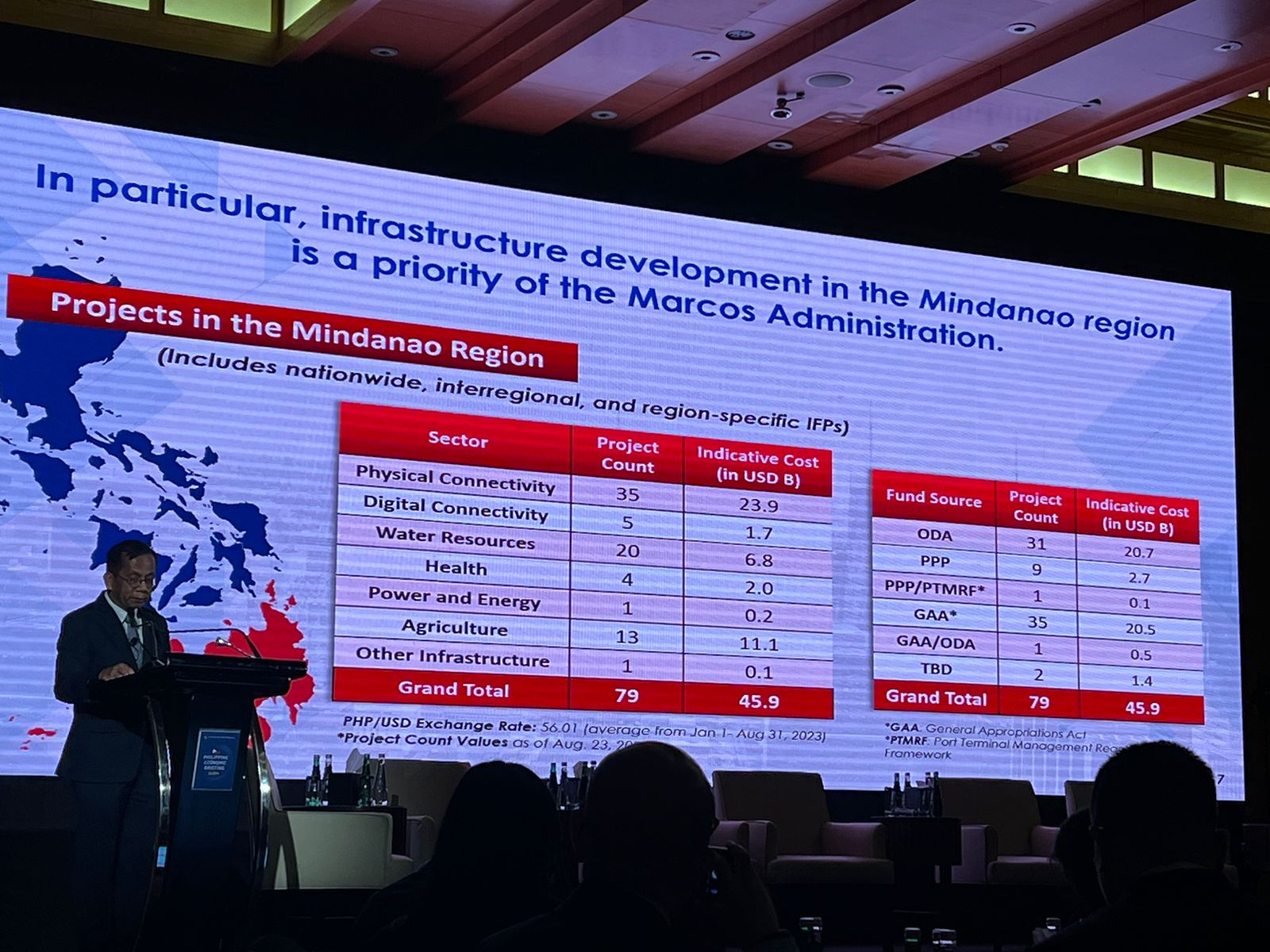

In closing, National Economic and Development Authority Secretary Arsenio Balisacan encouraged UAE investors to participate in the government’s 194 infrastructure flagship projects, many of which will receive public-private partnership funding.

These retail dollar bonds aim to democratize government securities, offering five- and ten-year tenures with interest rates of 1.375% and 2.25%, respectively.