The state-run social insurance program Social Security System (SSS) has released the new contribution table which takes into effect starting April 1.

Under the new matrix, land-based and sea based Overseas Filipino Workers with income below P8,250 per month will have to pay P960. The minimum monthly salary credit (MSC) for OFWs was set to P8,000.

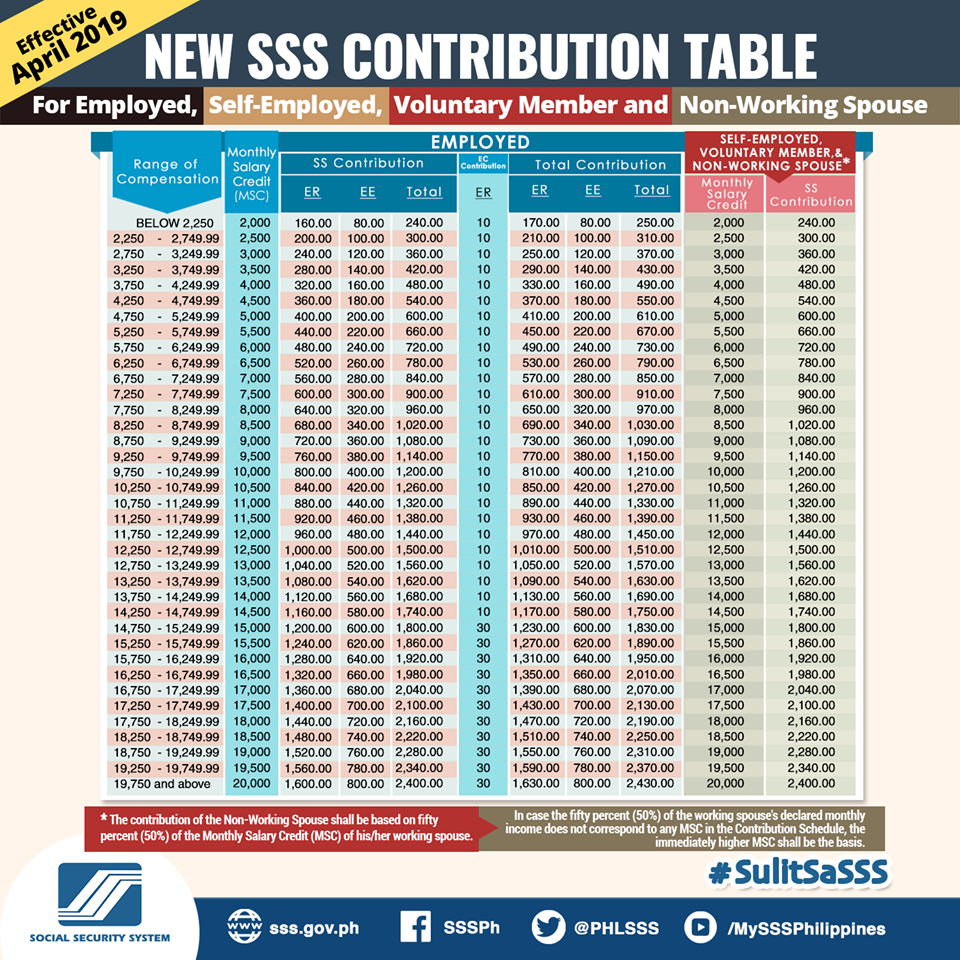

Those who earn P19,750 or above will have to pay P2,400 contribution. The maximum credited salary was also raised to P20,000. The same rates apply to self-employed or voluntary SSS member.

With the maximum credited income set at P20,000, even if an OFW’s income is much higher, the SSS contribution will no longer increase beyond the total amount of 2,400.

To recall, it was announced in February that SSS members and their employers would have to shell out more for their contributions with the announced 12 percent increase.

The state-run social insurance program said the move was aimed at replenishing the fund life by six years.

Meanwhile, a number of overseas Filipino groups and recruitment industry have voiced out their concerns regarding the impending implementation of the draft implementing rules and regulations (IRR) of Republic Act (RA) 11199, under which SSS premium payment will be a condition for Overseas Employment Certificate (OEC) issuance.

Blas F. Ople Policy Center (BOPC) Head Susan Ople called the IRR “flawed,” criticizing the draft for making the SSS premium payment a condition to issue OFWs their OECs.

“Why should social security become a condition for employment abroad?” Ople said, calling SSS to conduct additional consultations before it finalizes the draft IRR.

LEGEND: Employer’s contribution (ER), Employee’s contribution (EE), Contribution solely paid by your employer (EC)

Here’s the new contribution table for Employed, Self-Employed, Voluntary Members and Non-Working Spouse:

Meanwhile, former Bayan Muna Chairman Neri Colmenares and Bayan Muna Party-List Rep. Carlos Zarate also criticized the state pension for the imposition of mandatory contribution for overseas Filipino workers (OFWs).

Colmenares on Wednesday (March 28) argued that OFW membership should only be voluntary in consideration to their situations abroad.

Premium contributions of SSS members will increase by April, based on the new SSS charter.

According to its draft Implementing Rules and Regulations (IRR), a land-based OFW shall shoulder both the employer and the employee contributions until such time that the OFW’s host country enters into a bilateral agreement with the Philippines that will obligate employers to remit their contributions.

Currently, the state insurance agency’s premium contribution is P2,400 for overseas workers which they need to pay before they can leave the country.

The said amount will be added to the US$144 mandatory insurance being pushed by the government.

Zarate argued that such a measure might force OFWs to succumb to borrowing and eventually be buried in large amounts of debts.

The lawmaker also pointed out that this will only place OFWs at risk of being picked on by their employers which can eventually lead to dismissal.

Colmenares suggested that instead of being hard on their members by increasing their contributions, the SSS should improve its collection and go after delinquent employers in order to extend its fund life.