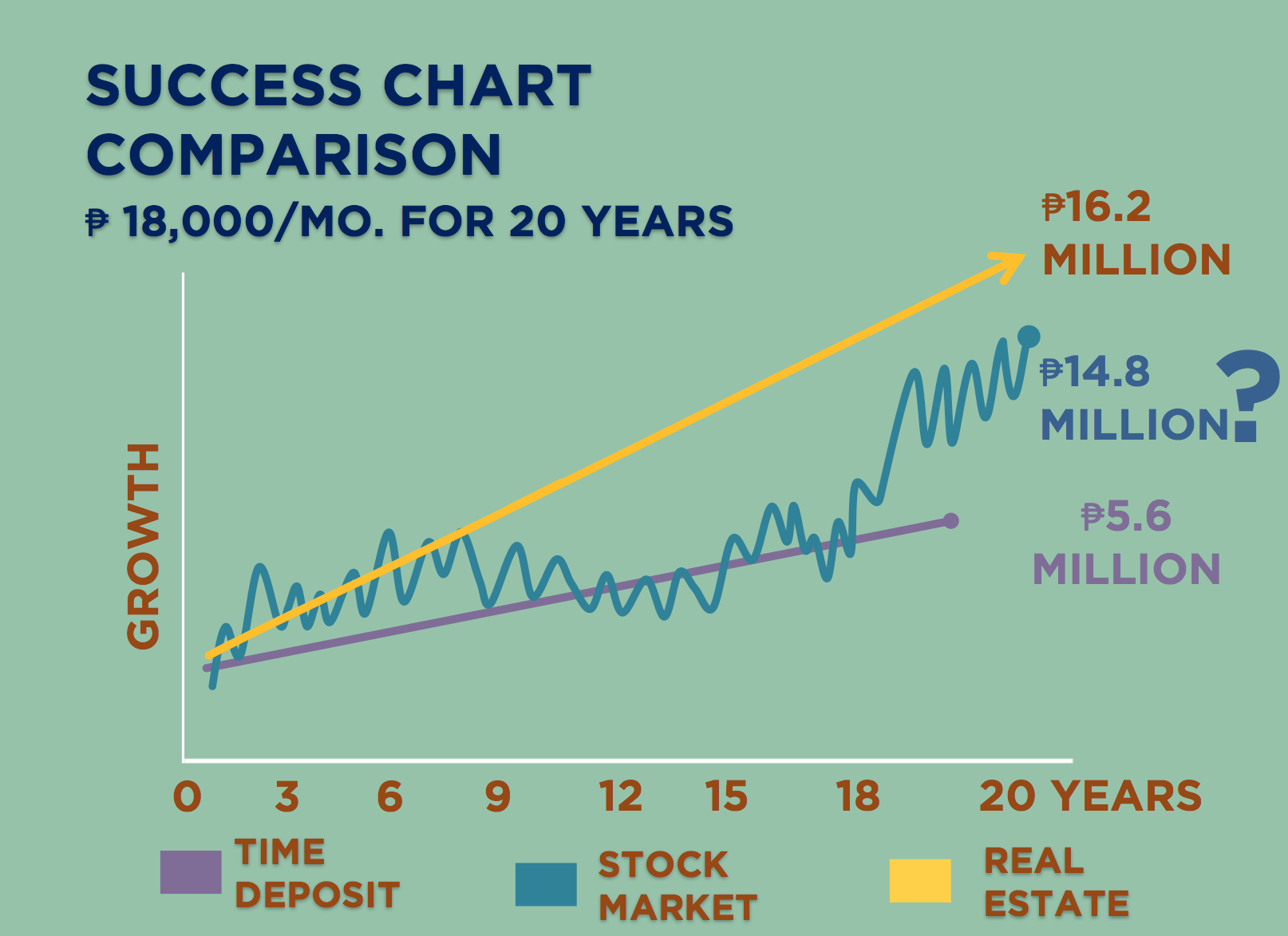

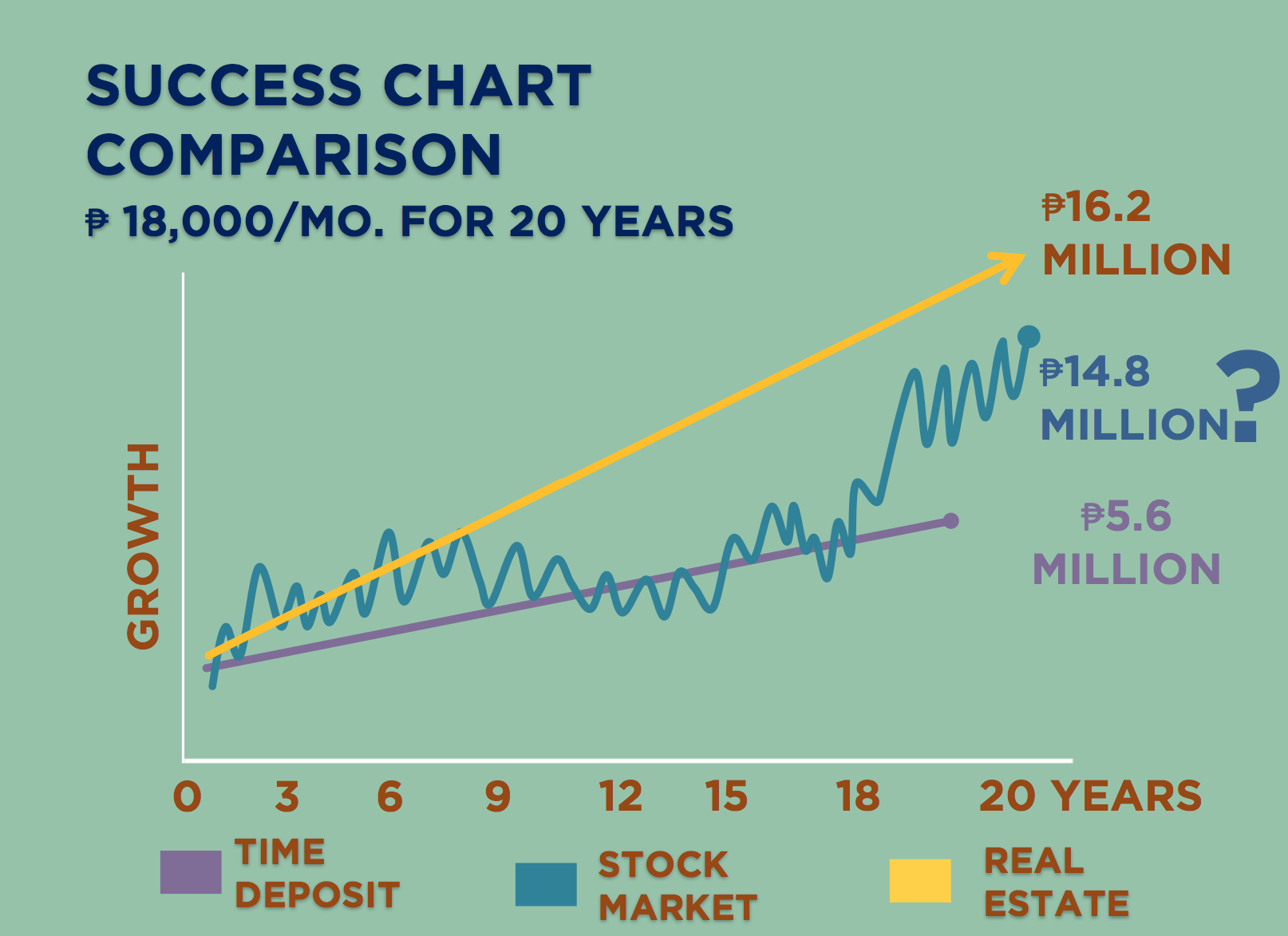

Investing in real property is a better business proposition because “it is like a time deposit where you get yields for renting it out” and, at the same time, is “similar to stocks” where the its value appreciates over time, said Ortigas & Co. Chairman, President and CEO, Jaime E. Ysmael.

“You get the best of both worlds,” he told The Filipino Times at the just concluded 5th edition of the Philippine Property and Investment Exhibition (PPIE) where he was among key resource persons.

Ysmael said time deposit has the “least risk” being an investment tool because your money is in the bank and it’s guaranteed. “But,” he said, “the rate is very low at 1% even less.”

“So, you don’t really build your wealth. In fact you lose your wealth because if you are earning only 1 % and the inflation is about 3%, you’ll end up poorer than when you started,” Ysmael said.

The stock market is a viable place to invest one’s money in and build wealth.

“But,” said the CEO, “the risk is actually the highest because it depends on whether you chose the right stock; the timing of the investment is also cyclical. You can lose your money if you don’t do it right.”

He said the stock market is not for the faint hearted. “You have to have the stomach for it because it can change overnight. So, you have to have a very long-term view if you want to invest in stocks,” Ysmael said.

How long is long-term?

“Invest your money in a good company then forget about it until 20 years later. That’s the kind of attitude that you should have.

So what will it be for you?

It will probably be more interesting to note too, Ysmael said, that banks have become more flexible in their rates.

“Rates have actually started improving since 2006-2007 when the banks became more liquid then they have become much more solid in terms of financial capability and hence were able to set loans longer,” he said.

“We have never seen banks lending at 20 to 25 years. So because of that, it became much more affordable. Plus, the good macro-economic environment led to lower interest rates, as well,” Ysmael added. (Jojo Dass)